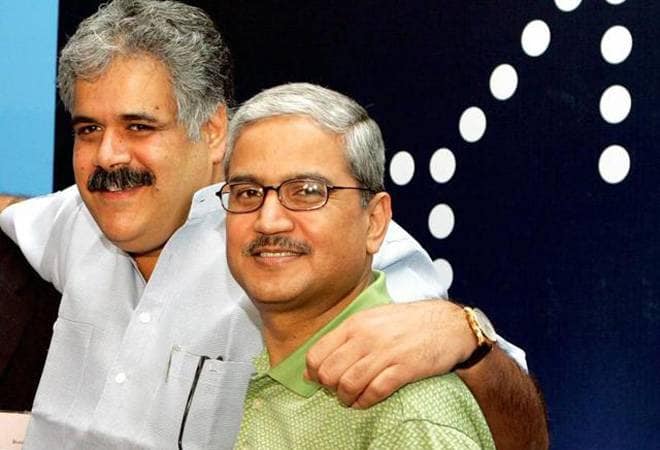

Tensions brewing at India’s largest airline IndiGo brought terrible news for the aviation sector. Differences between IndiGo’s promoters – Rahul Bhatia and Rakesh Gangwal – have reached a stage where both of them have sought opinions from the respective law firms. There are two roads from here. The case could be settled amicably by building a consensus on differing issues, although a difficult proposition. Or, the promoters could approach the National Company Law Tribunal (NCLT), as reported in the media.

Differences between the founder-partners are deeply embedded in IndiGo’s existing structure and strategy. Crucial differences include pace of expansion, use of aircraft for overseas operations and recent management changes. It seems that Gangwal’s signature is written all over IndiGo’s current strategy.

Gangwal, a veteran aviation professional, is reportedly in favour of aggressive expansion in both Indian and international markets, whereas Bhatia, who had background in travel technology and hospitality before starting IndiGo, prefers a cautious approach. IndiGo’s aggressive expansion over past two years has led to a furore in the sector with almost everybody raising doubts on its ability to fill up additional seats. For instance, the airline revised its capacity addition guidance over the last two years from 22 per cent in April-June quarter of 2017 to 34 per cent in January-March quarter of 2019. Adding a substantial 34 per cent capacity quarter-on-quarter and ensuring a healthy occupancy rate (80-90 per cent) are not easy.

IndiGo’s response to high capacity additions is low fares but that costs the airline a lot. IndiGo’s parent InterGlobe Aviation reported a loss of Rs 652.1 crore in the September quarter of 2018, its first quarterly loss since its listing in November 2015. The low fare-high demand scenario of past several years has led to weak yield growth at IndiGo. Its yield in June 2017 and December 2018 was similar – 3.83 per cent.

“IndiGo has kept fares low to stimulate demand. In India, nearly 70 per cent of the aviation demand is price elastic, which means that air passengers put off their plans to fly if fares are high. The aggressive expansion, especially in the domestic market, has proved to be a zero-sum game. With Jet going down, some of this additional capacity would have got absorbed easily at higher fares but the expansion plans were chalked out without factoring in Jet’s fall,” says an aviation consultant.

The other point of difference is the use of wide-body aircraft vis-a-vis narrow-body. Gangwal favours narrow-body aircraft like Airbus A321neos for its international operations, and codeshare agreements with other global carriers to cater to long-haul passengers whereas Bhatia sees higher value in wide-bodied aircraft for its international expansion.

Till last year, Airbus A321neo was a small part (25 planes) of the IndiGo’s strategy. In last November, the airline converted 125 A320neos (out of 405 planes) into A321neos, which would help it in flying to medium-haul destinations in Eastern Europe, China, Middle East and South East Asia. The flying range of A321neos is 7,400 kms as compared to 6,300 kms for A320neos. Last year, the airline secured traffic rights to fly to foreign destinations like Abu Dhabi, Kuala Lumpur, Kuwait, Male, Jeddah and Hong Kong.

The differences between Bhatia and Gangwal cropped up in earnings conference calls. For instance, in May 2018 call, Bhatia told investors, “We are actively studying the choice of wide-body aircraft and we will update you once we have made more progress on this issue.” In another call in October 2018, Greg Taylor, a man known to be close to Gangwal and whose appointment has become a reason of contention, said, “The sort of long-haul flying with wide body airplanes at this point remains more than an aspiration than a plan. But in the interim, we continue to add a lot of international markets that are within the range of A320 family airplanes.” In a way, this response from Taylor was aimed at downplaying Bhatia’s earlier statement.

“The news of dispute between the promoters of IndiGo has come out at a wrong time for the aviation sector, which is struggling to cope up after the Jet fiasco. Any continuing dispute or even rumours of differences will not do any good to the airline and impact the share value of the company. The promoters will have to face direct consequences in terms of financial losses,” says Neeraj Dubey, partner at Lakshmikumaran and Sridhanan Attorneys.

In addition, the recent hirings at IndiGo, be it CEO (Ronojoy Dutta), COO (Wolfgang Prock-Schauer), CCO (Willy Boulter), have raised fears in the Bhatia camp that Gangwal is trying to take bigger control over the airline for hiring people that are close to him.

It’s unlikely that media-shy promoters will come out to speak openly about the spat. Investors are expecting more clarity on the matter from IndiGo’s May 27 earnings call where the management is going to discuss its fourth quarter results. Like several other corporate fights, this spat has a fair chance of turning into an ego clash between two successful entrepreneurs and might derail the future of IndiGo.

[“source=businesstoday”]