Rising prices for clothes, hotel rooms and petrol have led to the highest rate of inflation in nearly two years, official figures show.

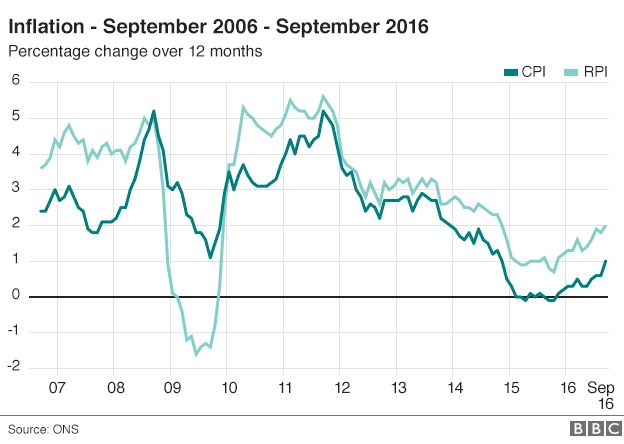

Inflation rose to 1.0% in September, up from 0.6% in August, the Office for National Statistics (ONS) said.

Clothing saw its biggest price rise since 2010 and fuel, which was falling a year ago, was also more expensive.

However, the ONS said there was “no explicit evidence” the lower pound was the reason for rising prices.

Kamal Ahmed: Not all about sterling – yet

Who wins from inflation?

The jump in the Consumer Prices Index (CPI) from 0.6% to 1.0% was the biggest month-on-month increase since June 2014.

The 1% rate is the highest since November 2014. However, ONS head of inflation Mike Prestwood said it was “low by historic standards”.

CPI measures the price of a “shopping basket” of more than 700 items, from the cost of women’s leggings to a multipack of fizzy drinks.

‘Price pressures’

Economists have predicted that prices will rise further, particularly when the fall in the pound makes food and clothing more expensive.

Ben Brettell, senior economist at Hargreaves Lansdown, said: “This will undoubtedly be tough on those with low incomes, and it’s also not good news for savers who are losing money in real terms.”

Sterling has dropped nearly 20% against the dollar since the Brexit vote, including a 5% fall this month after Theresa May set a timeline for the UK’s withdrawal from the EU.

Howard Archer, chief economist at IHS Global Insight, said: “Even before the pound has sunk to new lows in October, it is notable that price pressures were building up down the supply chain.

“In particular, producer output prices rose 1.2% year-on-year in September, which was the largest gain for three years and up from 0.9% in August.”

Kathleen Brooks, research director at City Index, said: “Oil imports are getting more expensive, clothing imports are also costing more, and the weak pound is boosting the tourism industry, which appears to already be fuelling a rise in hotel prices.”

Others said these pressures left the UK on course to exceed the Bank of England’s target of a 2% inflation rate.

Analysis, Kamal Ahmed, economics editor

The return of higher levels of inflation is likely to be one of the defining issues for Theresa May’s government.

The reason for that is simple.

Once the figure for inflation rises above the figure for wage growth – at present running at just over 2% – then incomes start falling in real terms.

That is politically uncomfortable for any government, particularly one that has staked its reputation on making the economy work “for everyone”.

Chris Williamson from forecasters IHS Markit said that target could be “breached within months, though much depends on the exchange rate and the extent to which costs continue to rise”.

Image copyrightISTOCK

Image copyrightISTOCKThe CBI business lobby group agreed, saying: “It’s still too soon for sterling’s recent depreciation to affect today’s inflation figures, however we do expect it to push up prices through the course of next year, which will hit the pound in people’s pockets.”

Statutory maternity and paternity pay, as well as some disability benefits, are set to rise, though, as they are linked to the September inflation figure.

The Retail Prices Index (RPI) measure of inflation, which includes mortgage interest payments, rose to 2.0% in September from 1.8% in August.

[Source:-BBC]