Partial leaks of Donald Trump’s 1995 tax returns raise more questions than they answer about the Republican presidential candidate’s finances.

As the New York Times reported when it disclosed the information, Mr Trump could have offset the massive losses he made that year against his income in subsequent years, perhaps even escaping any US income tax liabilities as a result.

We can’t be sure of that, because unlike other aspirants to the White House, Mr Trump has refused to release any of his tax returns.

There is no suggestion that he did anything illegal, but he certainly has no desire to clarify the issues. As far as he is concerned, avoiding income tax makes him “smart”, and several leading Republicans have backed him on that.

Even so, it is unclear how Mr Trump could have racked up the $916m (£717m) loss that he apparently reported.

It is a matter of record that he made some bad business decisions in the early 1990s, including the management of his casino empire, which has collapsed several times.

But given that not all the money invested in his casinos, his hotels and his failed Trump Shuttle airline was his own, it’s difficult to know how his personal tax loss could have been that great.

Some tax experts believe the figure could well have been a paper loss, inflated by accounting techniques, such as allowing for depreciation of assets’ market value.

Lobby groups

That points to another issue that clouds understanding here: the sheer complexity of the US tax code and the peculiar obstacles faced by anyone trying to change it.

John Cullinane, tax policy director of the UK’s Chartered Institute of Taxation (CIOT), points out that the last major reform of the US tax system occurred in the 1980s under Ronald Reagan’s administration.

Since then, the presidency and Congress have often been “at loggerheads”, with each controlled by a different political party.

“There’s a limit to which politicians can shut down legal loopholes,” he says. “You can’t stand up and say, ‘From midnight this will change,’ because you can’t get it through Congress.”

Image copyrightAP

Image copyrightAP“I know our complex tax laws better than anyone who has ever run for president and am the only one who can fix them,” Mr Trump has said in response to the New York Times article.

Of course, there is no need for such over-complication. At the heart of the matter is a very simple principle: that businesses should be allowed to offset past losses against future profits.

When a company is first set up, it may struggle to establish itself and lose money as a result. But if it succeeds, it will go on to create jobs and contribute to economic well-being.

The tax system is designed to help entrepreneurs with that aim in mind. The same principle applies in other countries, including the UK, although within certain limits.

The CIOT’s Mr Cullinane says that in the UK, a loss incurred in the property sector could only be offset against subsequent earnings in that same sector and not against money earned in other ways – a stricter set of rules than those applying to Mr Trump.

In fact, property developers such as Mr Trump appear to be particularly favoured by the US system. Remember that US public policy is often heavily influenced by well-organised lobby groups who enjoy a high degree of access to the corridors of Congress, and real estate is one of the key sectors for such lobbying.

According to the Center for Responsive Politics, a non-partisan research group, the National Association of Realtors has spent $21m on lobbying campaigns so far this year, making it the second-biggest spender among such groups.

As Mr Cullinane says, this means that there are far more tax breaks open to US entrepreneurs than to their British counterparts.

“In the UK, the amount of deductions has been severely pared away over the years,” he says. “Many deductions that used to apply are still the case in the US – there are more tax shelters.”

Goats and geese

Mr Trump’s familiarity with the resultant legal loopholes is not in doubt. For example, under farmland assessment programmes, developers can claim tax breaks on land that is used for agricultural purposes.

Mr Trump took advantage of this by installing a herd of goats on two golf courses that he owned in New Jersey, cutting his tax bill for the sites from $80,000 a year to less than $1,000.

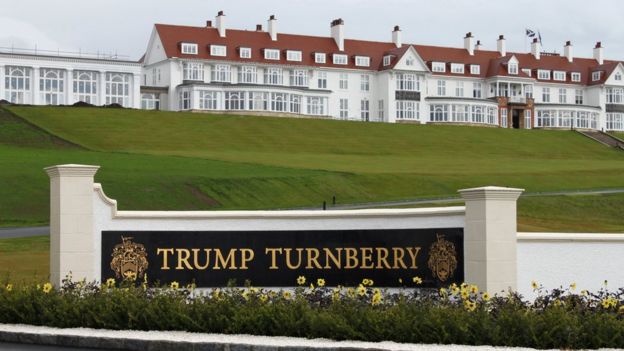

Image copyrightREUTERS

Image copyrightREUTERSSmall wonder, then, that Mr Trump’s rival in the presidential race, Hillary Clinton, has accused him of benefiting from a “rigged system”.

On the other hand, the absurdities of the tax code were not created overnight: it was political meddling by successive generations of Democrats and Republicans alike that made the system that way.

And as Mr Cullinane says, if Hillary Clinton became president, she would face “an uphill struggle” trying to change things.

The art of taxation, according to 17th Century French Finance Minister Jean-Baptiste Colbert, “consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing”.

Under the US system, however, some of the plumpest birds seem to get away with their plumage largely intact.

[Source:-BBC]